Both Ohio and the Federal law regulate the employment of minors, and the regulations vary depending on the minor’s age and when school is in session. The Fair Labor Standards Act (FLSA) and its Ohio equivalent extend protection to children by prohibiting the employment of “oppressive child labor” in commerce. The following guidelines must be considered when employing a minor at your dealership.

Significantly, a “minor” is anyone under the age of 18. With rare exceptions, the employment of any person under the age of 14 is prohibited. In general, the law regulates the hours of work and tasks performed. And in each case, the law applies a different standard depending upon the child’s age.

Hours of Work (Federal and Ohio Law)

Employment of persons 14 and 15 years of age is confined to:

- Hours outside of school hours;

- Not more than 40 hours in any week when school is not in session or not more than 18 hours in any week when school is in session;

- Not more than 8 hours on any day when school is not in session or not more than 3 hours in any school day;

Not before 7:00 a.m.;

- Not after 9:00 p.m. from June 1 to September 1 or during any school holiday of 5 school days or more; or not after 7:00 p.m. any other time.

Employment of persons 16 or 17 years of age is confined to:

- After 7:00 a.m. on any day that school is in session, except such person may be employed after 6:00 a.m. if the person was not employed after 8:00 p.m. the previous night; and

- Before 11:00 p.m. on any night preceding a day that school is in session.

Rest Period

Employees under the age of 18 must be given a rest period of at least 30 minutes for every five consecutive hours of work. The rest period need not be included in the computation of the number of hours worked by the minor.

Type of Work Permitted

Dealers and owners considering the employment of a minor need to know what kind of work a minor can perform.

Minors that are 14 or 15 years old can perform non-hazardous work in retail and gasoline service establishments that involve:

- Office and clerical work including selling and cashiering;

- Working a counter and picking and packing orders (as long as it does not involve the use of power driven machinery);

- Performing clean up and maintenance work both inside and outside the dealership (as long as it does not involve the use of power driven mowers and cutters. The use of vacuum cleaners and floor polishers is allowed);

- Car washing, cleaning, and polishing; and

- Dispensing gasoline and oil (as long as it does not involve the use of lifts, pits, racks, or other similar apparatus). Under Ohio law, youth under the age of 16 are expressly prohibited from performing work in connection with cars and trucks involving the use of pits, racks or lifting apparatus or involving the inflation of any tire mounted on a rim equipped with a removable retaining ring.

If an occupation is not specifically permitted by regulation, it is prohibited for youth ages 14 and 15.

The FLSA and its companion Ohio regulations specifically contain strict prohibitions against the employment of any individual under the age of 18 in “hazardous occupations.”

The following activities, though not an exclusive list, are deemed to be hazardous for all individuals under 18 within the meaning of this prohibition:

- Occupations in the operation of power driven metal forming, punching and shearing machines;

- Occupation in the operation of circular saws, band saws and guillotine shears;

- Using power-driven hoisting apparatus; and

- Wrecking and demolition operations.

Motor vehicle drivers and outside helpers on any public road or highway are deemed “hazardous” and are generally prohibited for individuals under the age of 18.

However, Ohio and Federal law do have exceptions to this general prohibition and some limited on-the-job driving may be performed by 16-year olds and qualified 17-year olds. There are some specific rules for both 16-year and 17-year olds. Also, there are some additional general regulations for any minor operating a vehicle as of a part of their occupation.

16-Year Old Federal Driving Rules

Licensed 16-year olds may be hired for jobs involving vehicle operation on private property, but not on public roadways. Therefore, they may move vehicles on dealership premises provided the criteria mentioned below are met.

17-Year Old Federal Driving Rules

17-year olds may drive on public roads while on the job so long as these provisions, along with those mentioned below, are adhered to:

- The driving does not involve route deliveries or route sales; the transportation for hire of property, goods, or passengers’ urgent, time-sensitive deliveries or the transporting at any one time of more than three passengers, including the employees of the dealership. Do not hire 17-year olds exclusively as parts delivery drivers.

- The driving performed by the minor does not involve more than two trips away from the primary place of employment in any single day for the purpose of delivering goods of the minor’s employer to a customer (except urgent, time-sensitive deliveries which are completely banned).

- The driving performed by the minor does not involve more than two trips away from the primary place of employment in any single day for the purpose of transporting no more than three passengers (other than the employees of the employer).

- The driving takes place within a thirty-mile radius of the minor’s place of employment.

- The minor has no records of any moving violation at the time of hire.

- The driving is only occasional and incidental to the employee’s employment.

o The term “occasional and incidental” is defined by Federal regulations as no more than one-third of an employee’s work time in any workday and no more than twenty percent of an employee’s work time in any workweek.

Additional Ohio and Federal Driving Rules

For any 16 or 17-year old, the following additional Ohio and Federal guidelines must be adhered to:

- The automobile or truck the minor is driving does not exceed 6,000 pounds gross vehicle weight.

- The vehicle is equipped with a seat belt or similar restraining device for the driver and for any passengers.

- The employer has instructed the employee that such belts or other devices must be used.

- The driving is restricted to daylight hours.

- The minor must hold a state license valid for the type of driving involved in the job performed and has no record of any moving violations at the time of hire.

- The minor has successfully completed a state-approved driver education course.

- The driving does not involve the towing of vehicles.

Remember, there is no exemption within the teen driving rules for family members who are employed by the dealership.

At the time of application, require prospective teen employee/drivers to sign waivers authorizing driving record and education background checks. Let prospective employee drivers know when they apply for employment that they must sign a written certification indicating compliance with the criteria listed above, if hired. Include in the certification a statement that any falsification or omission of information may result in termination. Keep a completed certification in employee personnel files. For teenage employee/drivers, certifications also should state they have been instructed to wear safety belts. Also, be sure to check with your insurance carrier regarding coverage. Finally, dealers should maintain logs of all driving done by teen drivers to ensure compliance with the regulations.

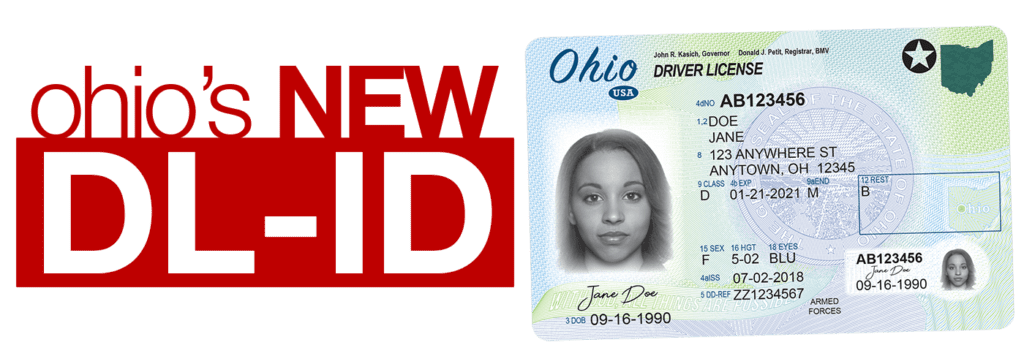

Proof of Age & Wage Agreemen

A dealership cannot provide employment to a minor without agreeing with the minor as to the wages or compensation the minor will receive for each day, week, month, or year; or per piece, for work performed. Dealerships must have a written agreement with the minor regarding these terms. The original agreement should be retained at the dealership, with a copy given to the minor and their parent/guardian (dealerships are advised to have the parent/guardian sign-off on the wage agreement as well). On or before each payday, the dealership must provide the minor with a statement of the earnings due and the amount to be paid. A dealership must not reduce the wages or compensation of any minor without giving notice at least twenty-four hours previous to the reduction, at which time a written agreement must be entered into with the minor as in the case of original employment.

A dealership cannot retain or withhold from a minor the wages or compensation, or any part thereof, agreed to be paid and due the minor for work performed or services rendered because of presumed negligence or failure to comply with rules, breakage of machinery, or alleged incompetence to produce work or perform labor according to any standard of merit.

A dealerships cannot receive a guarantee, bonus, money deposit, or other form of security to obtain or secure employment for a minor or to ensure faithful performance of labor, guarantee strict observance of rules, or make good losses which may be charged to the minor’s incompetence, negligence, or inability.

Age and Schooling Certificate

Also known as work permits, all minors who are in paid employment must have valid age and schooling certificates during the school year; and, 14-year and 15-year olds must have valid age and schooling certificates at all times of the year. Minors aged 16 and 17 are not required to provide an age and schooling certificate during summer vacation months but they are required to provide proof of age and a statement signed by the minor’s parent or guardian consenting to the proposed employment.

Recordkeeping Requirements

The dealership must keep a time book or other written records which state the name, address, and occupation of each minor employed, the number of hours worked by such minor on each day of the week, the hours of beginning and ending work, the hours of beginning and ending meal periods, and the amount of wages paid each pay period to each minor.

Posting Requirements

The dealership must maintain a list of all minors employed or being trained. This list must be posted on the dealership premises along with the Ohio Employment of Minors Law poster: http://www.com.ohio.gov/documents/laws_MLLPoster.pdf. These postings should be placed in plain view in a conspicuous area which is frequented by the largest number of minors and to which all minors have access.

This summary provides an overview of Ohio and federal laws. It is not intended to be, and should not be construed as, legal advice for any particular fact situation. For questions related to the employment of minors, contact your Fisher Phillips attorney at 440-838-8800.