Brands increasingly are promoting their own software, but dealers worry about giving up too much flexibility and consistency

By Lindsay VanHulle

The pandemic has made clear that selling cars online is a prerequisite for dealers to compete in an industry under pressure from multiple fronts.

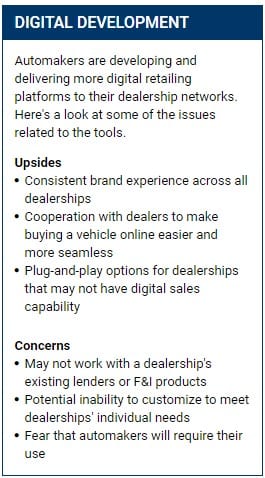

Yet the push to bring auto retailers into the digital age has some dealers feeling squeezed — and not just by the need to keep up with changing consumer expectations and disruptive rivals such as Tesla and Carvana. Automakers are investing in factory-branded digital sales tools and encouraging their dealers to adopt them.

Their efforts are landing in a market populated with similar tools from third-party software vendors as well as customized, branded shopping experiences from large public dealership groups. Automakers say they want to create consistency among their retailers and simplify transactions.

The rollouts haven’t always gone smoothly. Last month, for instance, Stellantis made a push to get dealerships onto its rebranded digital retailing tool, E-Shop, but some retailers mistakenly thought they were being forced to drop their current provider. Stellantis says the tool is optional.

For some dealerships, particularly those that aren’t yet deep into online sales, the auto brands’ software could be an easy way to plug in the capability, experts say. And the industry shares the goal of eliminating pain points that leave customers dissatisfied — such as the time spent waiting at a dealership to finish a deal or the need to redo steps because online forms didn’t transfer information to the in-store process.

Some retailers, however, say the automakers’ forays into digital transacting raise concerns, including whether the efforts will be mandated and whether they’ll be flexible enough for dealers to integrate their existing lender relationships and finance and insurance products.

The National Automobile Dealers Association relays dealers’ concerns about some of the automakers’ digital retailing tools, including the ways some were rolled out, directly to manufacturers, spokesman Jared Allen said in an email.

“One of the main areas of dealer concern is the potential for OEM digital retailing tools to be a conduit to further OEM control over the customer experience and retail process,” Allen told Automotive News. “Dealers have done a remarkable job of adopting digital retailing platforms recently — and most importantly, they did so in direct response to evolving consumer preferences, and often without direct OEM assistance. We continue to have constructive conversations with OEMs about the importance and value of maintaining flexibility and dealer choice wherever possible so that dealers can best meet the needs and expectations of their individual customer bases.”

Paired with brands’ plans to bring more electric models to market — in some cases with preorders funneled through automakers’ digital platforms — questions remain about how much control of the sales process manufacturers ultimately are after.

“If you don’t want to participate, you’re just not going to be there [for customers], so you’re going to miss out on that opportunity,” said Jason Cole, executive vice president of Cole Automotive Group.

For Cole, whose stores sell Nissan, Honda, Ford, Lincoln, Subaru and Kia vehicles in West Virginia and Kentucky, concerns about brands’ sales platforms include flexibility — particularly around choice of lenders and F&I products — and cost competitiveness with third-party offerings.

Fear of missing out

One of Cole’s brands, Nissan, this year launched Nissan@Home for consumers to browse, schedule a test drive or start a purchase online. Dan Mohnke, Nissan’s U.S. vice president of eCommerce, said about one-third of the brand’s 1,074 U.S. dealerships have signed up, and Nissan plans an advertising campaign for it this year.

Cole isn’t sure whether he will sign up, but if Nissan puts a lot of money behind it, he doesn’t want to miss out on prospective buyers by keeping his stores out of the pool.

“I don’t think it’s right what they’re doing,” Cole said, “but it’s almost like they’re forcing our hands.”

Taking a restrictive approach with Nissan@Home wouldn’t get dealers on board, Mohnke said, so the platform integrates with at least 60 lenders and allows dealers to control what inventory, pricing and F&I products they feature.

It’s designed to bring more consistency and value to the dealership network, he said.