EV sales grew nearly 50 percent this year but have plateaued in recent months

By Sean McLain | sean.mclain@wsj.com and Nate Rattner | nate.rattner@wsj.com

Electric-vehicle sales growth hit a speed bump in the U.S. this year, and the impact is being felt throughout the industry.

Carmakers around the world have invested billions of dollars in EV technology, spurred on by tailpipe emissions regulations designed to boost sales of battery-powered models. But as customers in the U.S. hesitate to make the switch from traditional gas-engine vehicles, some auto companies are delaying plans on electric-vehicle spending.

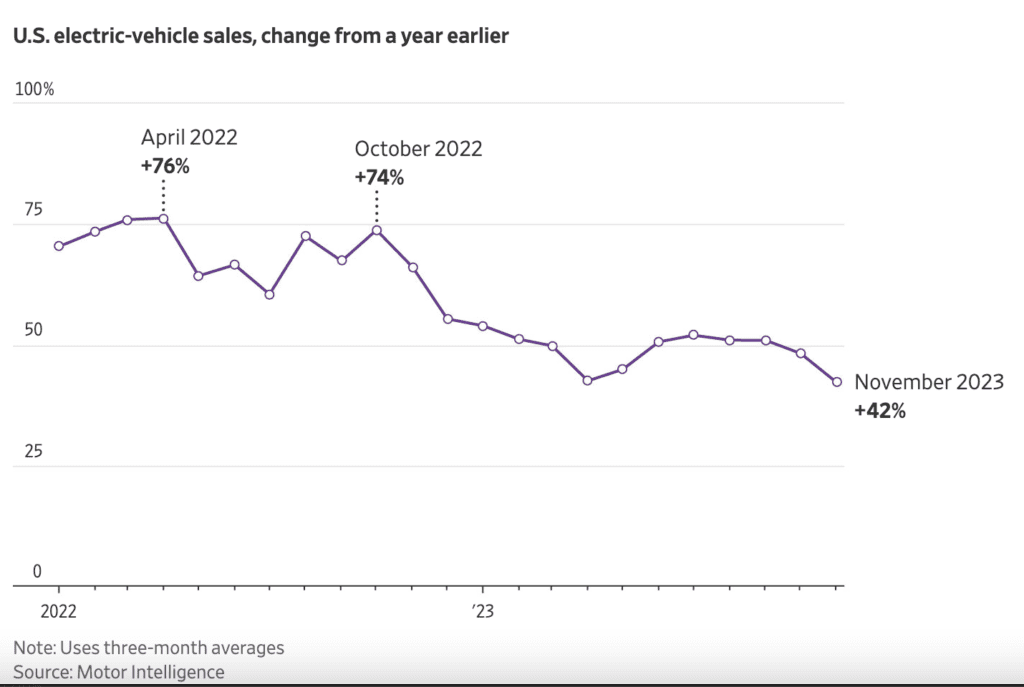

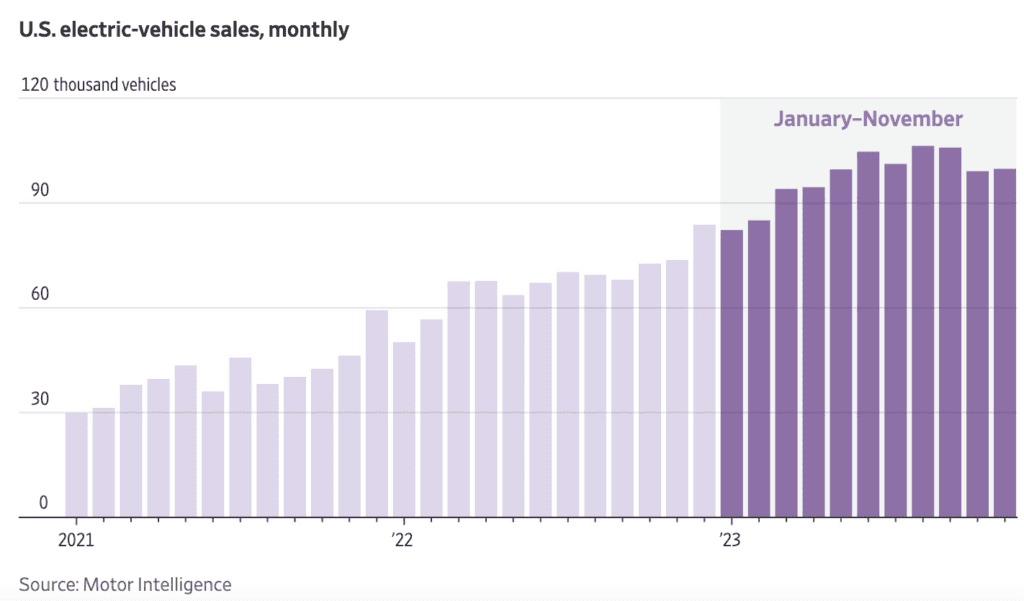

Sales of electric models rose rapidly in the first 11 months of the year, faster than the car market as a whole but at a slower pace than in previous years.

Car executives say they are confident that sales will accelerate as additional lower-priced models come out and the availability of public chargers improves.

In the near term, the cooling buyer interest has weighed on U.S. makers that had ramped up vehicle and battery production in anticipation of a larger surge in customer demand. Electric-vehicle sales began to stall in the latter half of this year, a move that car executives attributed to the relatively high prices of electric models.

As a result, electric cars and trucks are piling up on dealer lots, causing auto companies to reassess their investment plans. It takes a dealership around three weeks longer to sell an EV than a gasoline vehicle, according to data from car-shopping website Edmunds. A year ago, battery-powered models were selling faster than their gasoline counterparts.

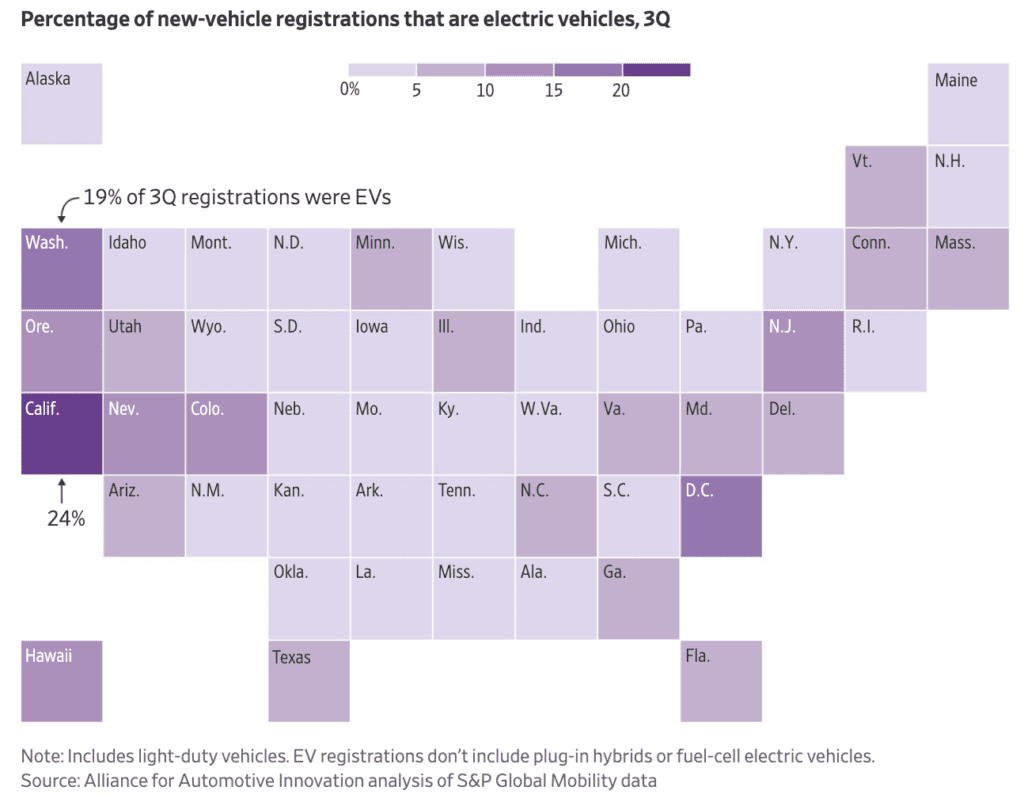

Part of the challenge for automakers is that demand for electric models isn’t spread evenly across the U.S. Sales are concentrated in a handful of states, according to data from S&P Global Mobility.

Between July and September, nearly a quarter of all vehicles sold in California were EVs, compared with a little over 3 percent in Michigan where General Motors and Ford Motor have their headquarters, according to the trade group Alliance for Automotive Innovation, which analyzed data from S&P Global Mobility. Most buyers are in urban areas, where public charging infrastructure is more readily available, say dealers and car executives.

Through September, six of the top 10 car markets for electric cars and trucks were cities on the West Coast, and the top four were metropolitan areas in California, according to S&P Global Mobility.

Dealers and carmakers say many American car buyers are still reluctant to ditch their gas vehicles for an electric model, put off by the relatively high price of the technology and concerns about their ability to recharge them easily.

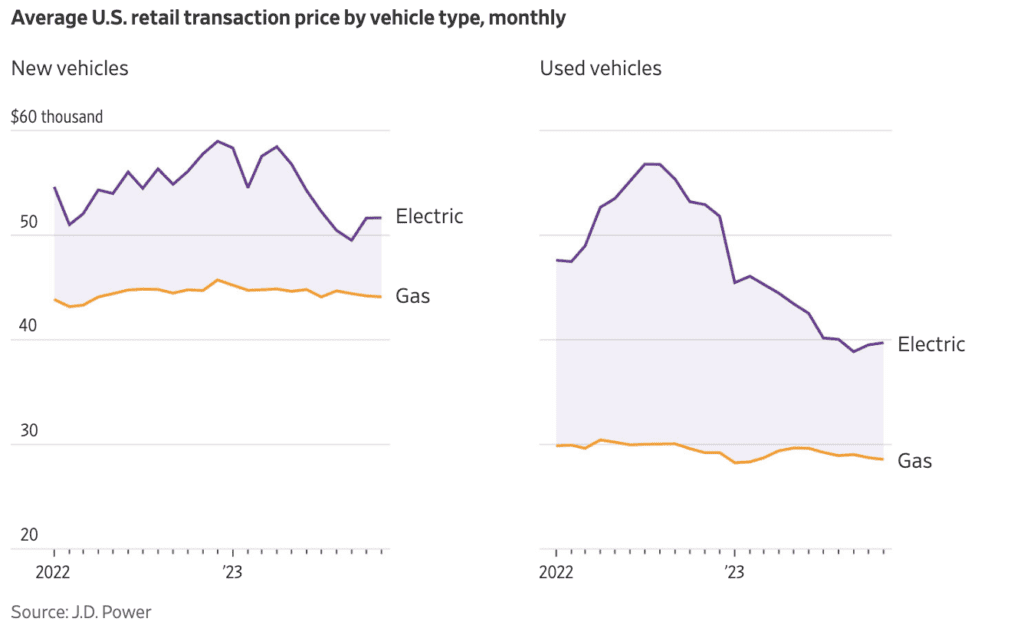

Automakers are offering a combination of discounts and lower interest-rate deals in an attempt to draw in buyers. Those markdowns have led to a sharp decline in new EV prices and an even steeper decline for their counterparts in the used-vehicle market.

American car buyers paid $51,668 for a new EV in November, compared with $44,112 for a new gasoline-powered model, according to J.D. Power data.

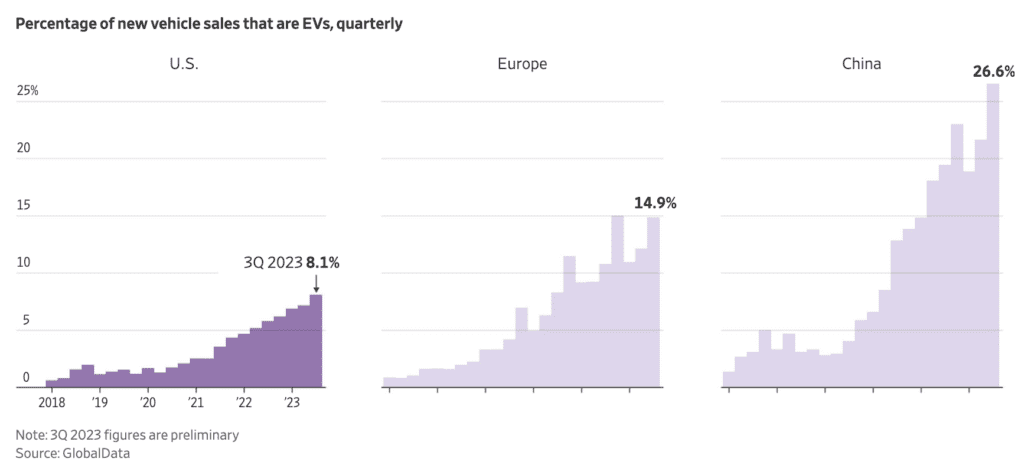

Electric-vehicle sales in the U.S. have been slower to take off compared with the world’s other two large car markets: China and Europe. Nearly 27% of the vehicles sold in China were battery-powered models in the third quarter, compared with around 8% in the U.S., according to preliminary data from research firm GlobalData. In Europe, nearly 15% of the vehicles sold in the third quarter were EVs.

Analysts say that trend is partly caused by China and Europe moving earlier and more aggressively to promote sales of electric vehicles with a combination of government subsidies and tougher emissions regulations. Analysts say that the U.S., as a relative latecomer, needs more time for car companies to release more electric models and for consumers to become comfortable with the technology.

Auto executives and analysts say that a lack of affordable models is preventing electric-vehicle sales from taking off in the U.S., but that this is likely to change in 2025, when lower-priced options are expected to become available.

“We’re going to start to see more of these EVs under $35,000 to $40,000,” said Stephanie Valdez Streaty, an analyst at automotive services company Cox Automotive. “It’s a major transition. It will go forward, but there will be major bumps and zigzags.”